Frank Schwab

I bridge the gap between Visionary

Technology and Balance Sheet Profitability

The Middle is a Death Zone:

Why Banks Must Innovate or Liquidate

The Illusion of Stability

For decades, the banking industry has rested on a comfortable misconception: that possessing a banking license is a business model in itself. This era is irrevocably over. We are witnessing the brutal bifurcation of the financial sector, a phenomenon I call the "hollowing out of the middle." Today, a bank has only two viable strategic destinies: it must either relentlessly develop new products and markets to own the customer interface, or it must aggressively sell its capabilities as a utility provider. If a bank is merely "maintaining" its current portfolio, it is already a zombie institution—it just hasn't checked its own pulse yet. The figures are not just alarming; they are a scathing indictment of traditional management.

The heavy burden of "Running the Bank"

Let us look at the cold, hard facts of the "Maintenance Trap." In 2024 and 2025, data from major consultancies like Gartner and McKinsey consistently highlighted that traditional financial institutions still allocate between 70% and 80% of their IT budgets merely to "run the bank"—keeping the lights on and patching legacy systems. Only a meager 20% to 30% is invested in "change the bank" initiatives or genuine innovation. This is a suicidal ratio in a digital economy. While agile fintechs deploy code fifty times a day, traditional banks are shackled by COBOL cores from 1978, spending billions just to stand still. Research indicates that global spending on maintaining outdated dbanking technologies is projected to surge toward $57 billion by 2028, a colossal tax on inefficiency that provides zero value to the end customer.

The Metric of Mediocrity

The starkest evidence of this failure is the Cost-to-Income Ratio (CIR). Efficient, tech-driven neobanks and platform players operate with CIRs in the 30% to 40% range. In contrast, many traditional European incumbents are still celebrating when they wrestle their CIR down to 60% or 65%, as seen in recent 2025 reports from major players like Société Générale. This 25-point gap is not a margin of error; it is a structural competitive disadvantage that no amount of branch closures can fix. If your primary activity is maintaining a bloated infrastructure that consumes 65 cents of every Euro earned, you are not a technology company; you are a legacy preservation society.

Path A: The Developer (Owning the Customer)

The first viable path is to become a ruthless Developer. This does not mean launching another "me-too" mobile app or a slightly shinier credit card. It means shifting from selling "banking products" to solving "customer problems" through hyper-personalized, AI-driven ecosystems. Accenture's "Banking Trends 2026" report highlights that we are entering an era of "Unconstrained Banking," where Generative AI breaks the link between headcount and capacity. A "Developer" bank uses this power to create value-added services that go beyond finance—integrating deeply into the gig economy, mobility, or health sectors. However, the hurdle here is massive: studies show that 70% of digital transformations fail to meet their objectives, largely because banks try to layer new innovation on top of rotting "spaghetti code" rather than rebuilding their core. To succeed here, you must be willing to cannibalize your own revenue streams before a competitor does it for you.

Path B: The Seller (Owning the Infrastructure)

If a bank lacks the DNA to innovate at the speed of Amazon or WeChat, it must pivot to the second path: becoming a Seller of capabilities. This is the "Banking-as-a-Service" (BaaS) play. The market for BaaS and white-label banking is exploding, with forecasts projecting it to reach over $137 billion by 2035, growing at a CAGR of nearly 15-20%. In this model, the bank retreats from the front line, becoming the invisible, highly efficient utility that powers the brands people actually love—the Apples, the Ubers, and the niche fintechs. This requires stripping down to the bare metal, selling off non-core business units, and achieving operational excellence that rivals a cloud provider. It is not a retreat; it is a strategic repositioning to where the volume is.

The Fallacy of "Maintaining"

The danger lies in the boardroom that chooses neither. This is the bank that decides to "maintain" its current position, deluding itself that high interest rates will protect it forever. This strategy ignores the reality of customer churn, which is increasingly driven by "silent attrition"—customers keeping their primary account but moving their profitable activities (investing, FX, lending) to specialized digital players. The "Maintainer" suffers from the worst of both worlds: the high cost base of a legacy incumbent and the diminishing relevance of a stagnant utility. They are sitting ducks for the "platform economy," where value aggregates at the extremes of the value chain, leaving the middle to starve.

Conclusion: The 36-Month Ultimatum

The window for decision-making is closing. We are not looking at a ten-year horizon; the winners of the 2030s are being determined in the boardrooms of 2026. A bank must honestly assess its capabilities: Does it have the talent, culture, and technology to be a world-class Product Developer? If the answer is "no"—and for 90% of banks, it is—then it must immediately restructure to Sell its infrastructure and balance sheet access. To continue "maintaining" is to choose a slow, agonizing liquidation. The market has no mercy for mediocrity, and in the digital age, being average is the fastest way to become obsolete.

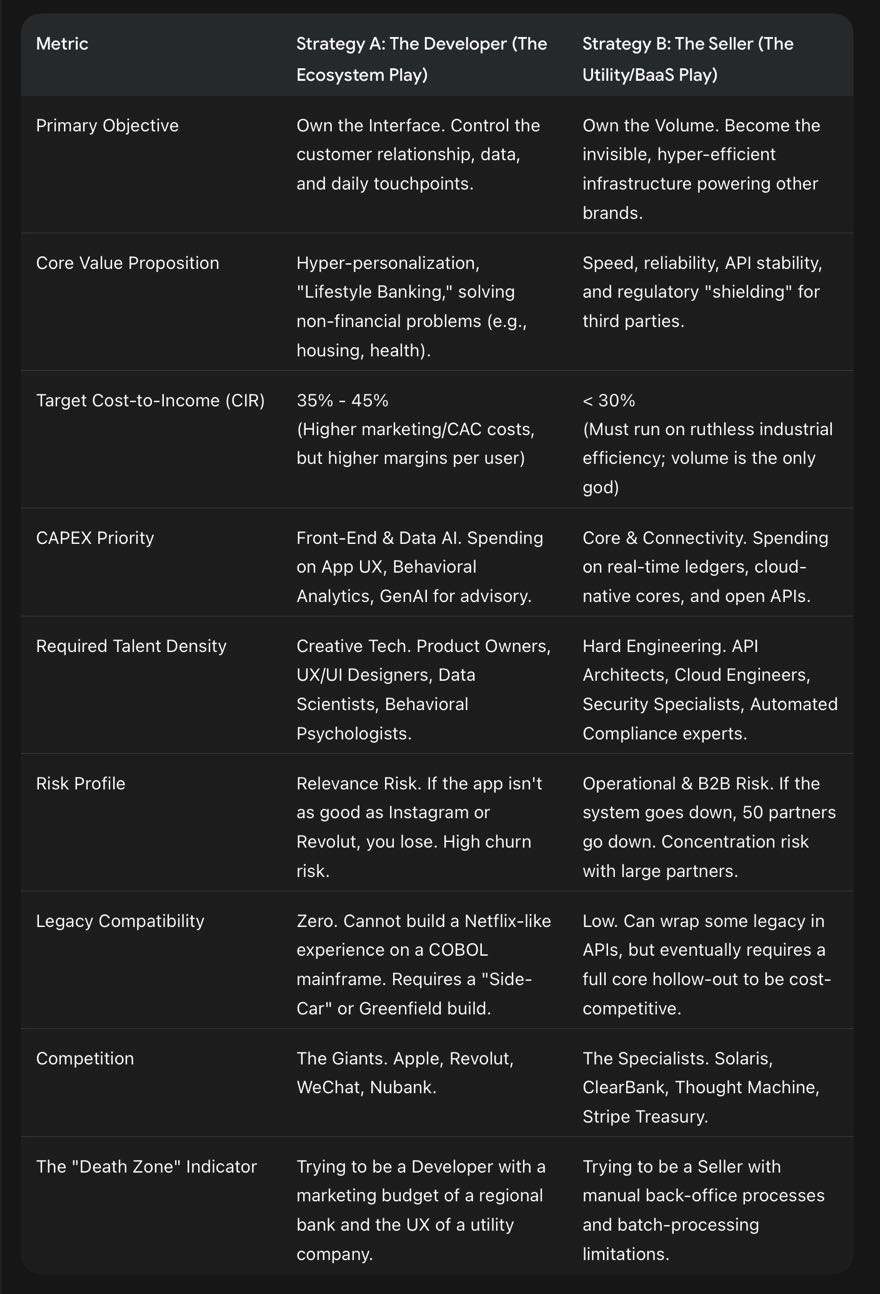

Strategic Decision Matrix: Developer vs. Seller

#FutureOfBanking #Fintech #BaaS #Strategy #InnovateOrDie #42megatrends

© Frank Schwab 2026