5 Imperatives for Board Leadership in Digital Banking Transformation

„Digital banking transformation is not a choice—it's imperative for survival.“

The banking sector stands at the precipice of unprecedented change, driven by the inexorable march of digital transformation. In this era, where adaptation is synonymous with survival, the role of board leadership in steering financial institutions towards a digitally empowered future cannot be overstated. Proactive board leadership is crucial to help financial institutions not only keep pace but lead the way in crafting the bank of the future.

In my experience the following five imperatives for board members are crucial for effectively navigating the digital landscape, ensuring not only the relevance but also the leadership of their institutions in shaping the bank of the future.

1️⃣ Digital as Core Strategy

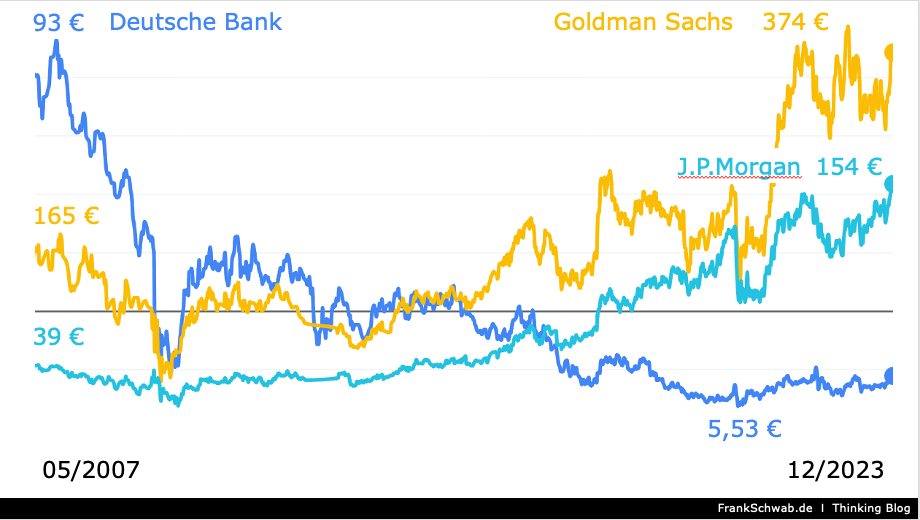

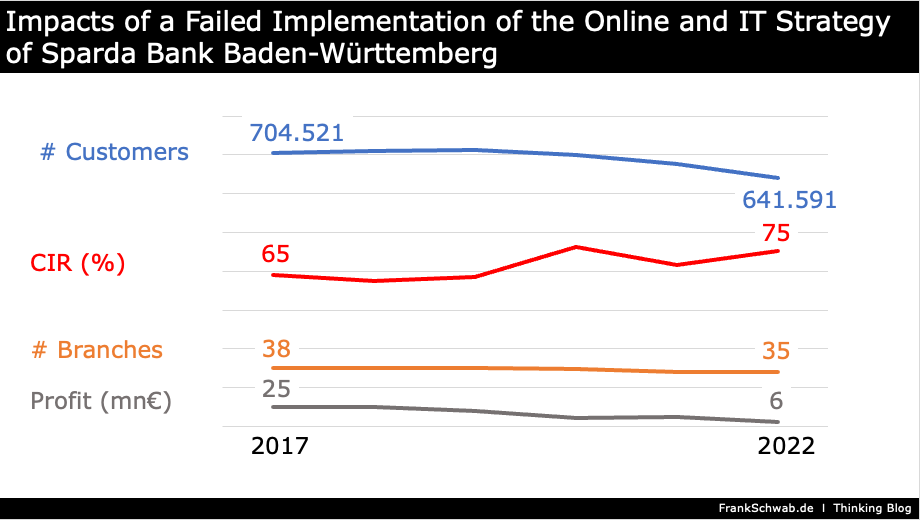

In the digital age, strategy cannot afford to treat transformation as an ancillary endeavor but must integrate it as the very essence of the institution's trajectory. Board members must be the vanguards in this endeavor, asking pertinent questions, driving alignment, and identifying requisite digital talent. Key performance indicators (KPIs) such as Digital Channel Adoption Rate, Digital Sales Percentage, and Cost-to-Income Ratio serve as crucial barometers in assessing the efficacy of digital strategies.

2️⃣ Cultivating a Culture of Innovation

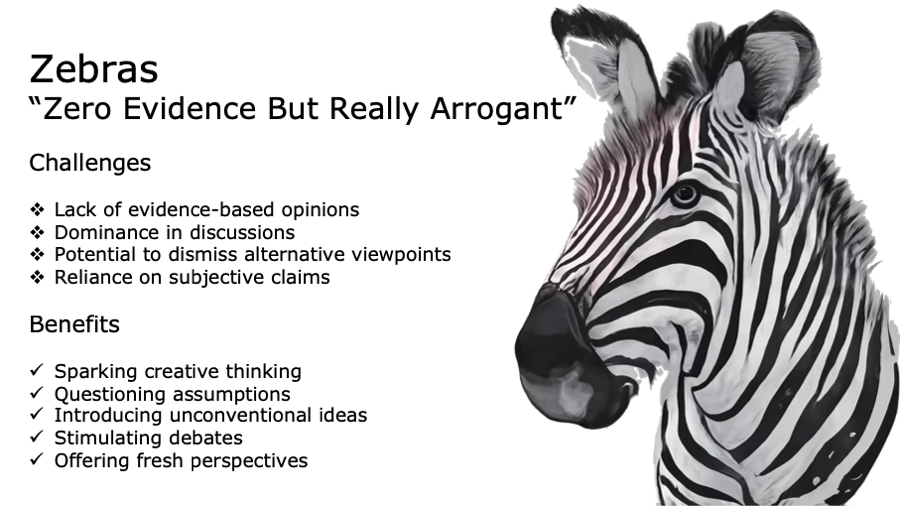

The ethos of innovation must permeate every facet of traditional banking institutions, necessitating a cultural metamorphosis. Board members play a pivotal role in championing agility and collaboration, fostering an environment conducive to rapid experimentation and cross-functional partnerships. KPIs such as Time-to-Market for New Products/Features, Employee Engagement with Innovation Initiatives, and Customer Feedback on New Features are instrumental in gauging the institution's innovation quotient.

3️⃣ Evolving the Customer Experience

In the digital realm, customer experience reigns supreme, and board members must prioritize its enhancement. Advocating for the voice of the customer, championing seamless journeys, and tracking KPIs such as Net Promoter Score, Digital Self-Service Resolution Rate, and Channel Abandonment Rate are imperative in ensuring that the institution remains attuned to evolving customer expectations.

4️⃣ Leveraging Data as a Strategic Asset

Data emerges as the linchpin in the digital banking paradigm, necessitating a strategic approach guided by board leadership. Establishing robust data governance policies, fostering insights-driven decision-making, and tracking KPIs such as Data Quality Index, Insights-to-Action Time, and Customer Personalization Effectiveness are pivotal in harnessing the transformative power of data.

5️⃣ The Cybersecurity Imperative

As banking operations traverse the digital realm, cybersecurity assumes paramount importance, demanding unwavering vigilance from board members. Oversight, a proactive stance, and adherence to compliance standards become non-negotiable imperatives. Tracking KPIs such as Number of Security Incidents, Incident Response and Recovery Time, and Compliance with Security Standards are indispensable in safeguarding the institution against cyber threats.

Conclusion

In conclusion, the digital revolution presents both unparalleled opportunities and formidable challenges for the banking sector. Board leadership, armed with a keen understanding of the imperatives outlined herein, holds the key to navigating this tumultuous terrain successfully. By embracing digital transformation as a core strategy, fostering a culture of innovation, prioritizing customer experience, leveraging data strategically, and fortifying cybersecurity measures, board members can chart a course towards a future where their institutions not only survive but thrive in the digital age.

Published in digital, transformation, digital, banking, KPIs, customer, satisfaction, innovation, supervisory, board on 25.03.2024 19:31 Uhr. 0 comments • Comment here