7 Reasons Why Strategy Implementations Fail in Banks

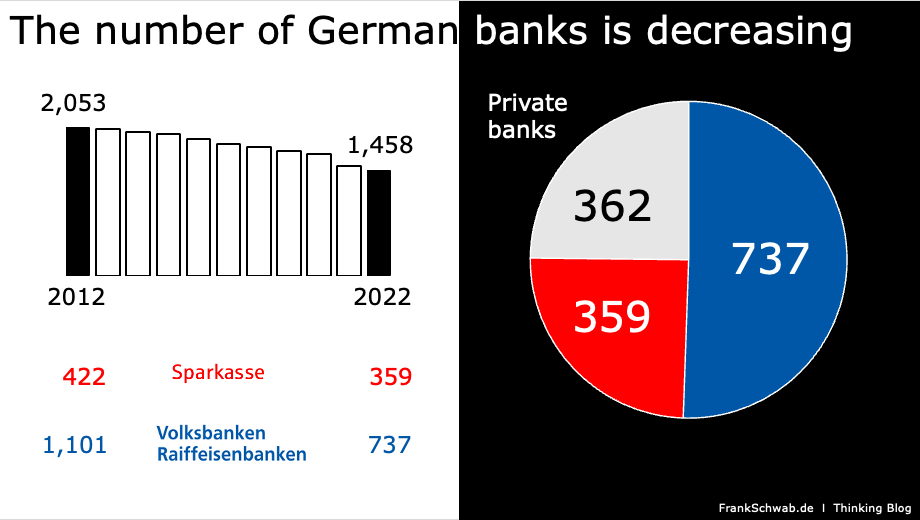

A strategy that attracts customers, sets itself apart from the competition, and leads to a sustainable and profitable business model is particularly crucial for German banks. For many, it is even a matter of survival. Between 2012 and 2022, more than a quarter of all banks, approximately 600, bid farewell to the German banking landscape. Savings banks and cooperative banks were mostly merged, and many private banks were either acquired, forcibly liquidated, or gave up. The strategies of the banks that disappeared from the German market evidently did not succeed.

For the supervisory boards and executive boards of the remaining 1,450 banks, the question arises as to why strategies and their implementations often fail and whether they might soon be affected themselves.

One approach to addressing the issue is to better understand the causes of failure with the aim of avoiding them. While one might assume that failure is mostly rooted in a poor or vague strategy, consulting literature on the topic, such as "Successful Strategy Execution" by Michel Syrett or "The space between strategy and execution" by Gregg Harden, reveals that approximately 50 to 70% of all business strategies fail in their implementations. Another approach is to analyze the strategies and implementations of individual banks in order to learn from them.

Unstable leadership, conflicts in management, and distraction from necessary implementation measures

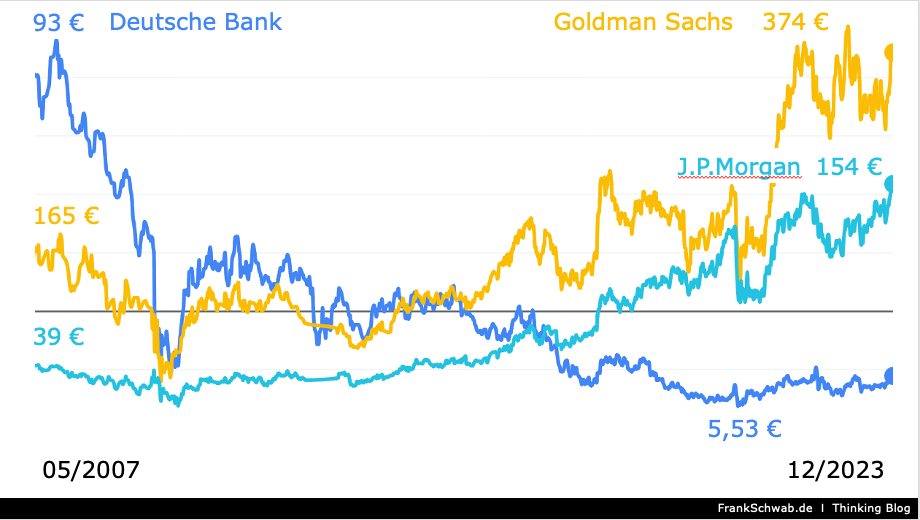

Deutsche Bank has been pursuing the strategy of the "Global Universal Bank - as the leading bank in Germany with strong European roots, a global network, and a diversified product offering." Interestingly, the bank has been following this strategy since its founding in 1870. The acquisition of Postbank, on which the bank has been working, albeit with varying intensity and focus, since 2007, does not quite fit into this picture. Most German retail customers do not need global products such as currency accounts or global wealth management. The majority of these customers require few, easily accessible, reliable, and efficient banking products, such as affordable accounts with cards, fast transfers, low-risk investment products with satisfactory returns, and affordable loans.

Since 2007, the Deutsche Bank has seen five (co-) CEOs - Josef Ackermann, Jürgen Fitschen / Anshu Jain, John Cryan, and Christian Sewing - and with each change, the approach to retail customers and Postbank has changed, sometimes aiming for full integration, sometimes contemplating a sale. The acquisition of Postbank is certainly not solely responsible for the stock market losses of occasionally over 90%. These developments can be attributed to the risks undertaken in the Deutsche Bank's investment banking and the consequences of the financial crisis. However, it seems that the purchase of Postbank has significantly diverted the leadership of Deutsche Bank from the core strategy of being a "Global Universal Bank."

Few significant milestones for the global universal bank have been reported in the last 15 years, while there have been numerous global scandals, regulatory irregularities, and very high fines in several countries. From my perspective, Deutsche Bank has the right strategy but lacks consistent implementation. The frequent changes at the top of Deutsche Bank have repeatedly led to power struggles and conflicts in management, at the expense of a focused strategy implementation.

American banks like Goldman Sachs and J.P. Morgan, with whom Deutsche Bank competed on equal footing around the turn of the millennium, demonstrate that a different approach is possible. Both banks implemented their strategies despite the financial crisis, more than doubling (GS) or nearly quadrupling (JPM) their stock prices between 2007 and 2023. This success is likely tied to leadership stability - Jamie Dimon has been the CEO of J.P. Morgan since 2006, and Goldman Sachs had only one change at the top in the last 18 years, with Lloyd Blankfein serving as CEO from 2006 to 2018 for 12 years, succeeded by David Solomon in 2018.

Overestimation, lack of online and IT expertise, and insufficient transformation experience

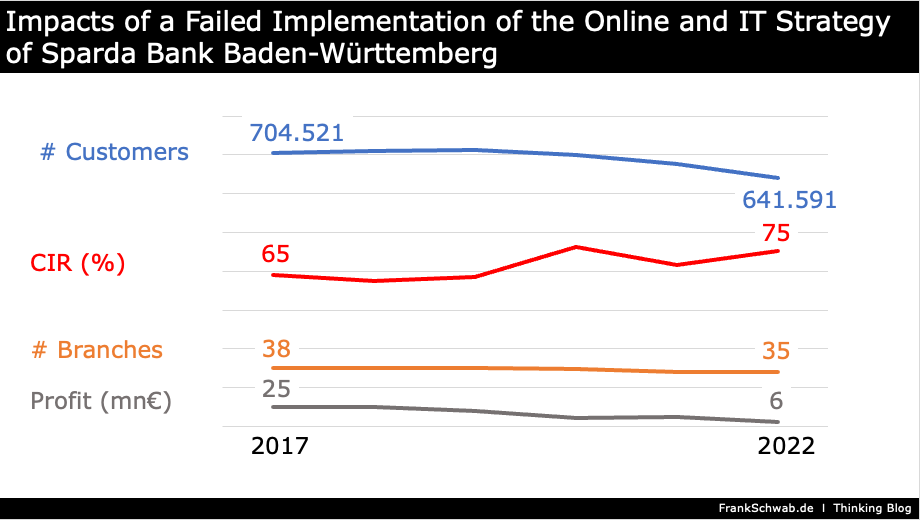

Sparda Bank Baden-Württemberg (Sparda-BW) is a regional cooperative bank with 640,000 private customers, 35 branches, and a balance sheet total of 15.6 billion euros (2022) in Baden-Württemberg. Faced with increasing competition from specialized online and neobanks such as N26, DKB, and ING, Sparda-BW took the lead from 2017 onwards (together with other Sparda banks) in developing a new online strategy with the aim of modernizing online banking for private customers (Project "TEO") and began the transformation of its existing core banking IT system landscape from 2019 onwards (Project "SFT"). As a customer of Sparda-BW, one was forcibly migrated to the new TEO platform. The usability, functionality, and convenience of TEO are not even close to the extensive and user-friendly features offered by direct competitors like N26 or Revolut. This can now also be seen in customer numbers. The number of Sparda-BW customers has decreased from 704,521 in 2017 to 641,591 in 2022, while competitors have gained hundreds of thousands of new customers in Germany. Between 2017 and 2022, the Cost-Income Ratio (CIR) also deteriorated from 65% to 75%, and Sparda-BW's profits fell from 25 to 6 million euros. During the same period, three branches were closed.

The poor results of Sparda-BW are the result of a poorly executed and excessively expensive implementation. According to Finanz-szene, a German banking news platform, the implementation costs for TEO amounted to 63 million euros, while N26 needed only 24 million for a comparable solution. Moreover, the core banking transformation project SFT has completely failed, as reported by the operator and Sparda-BW. The reasons for the failure of Sparda-BW's strategy are apparent. While the strategy of becoming a modern online bank for private customers is undoubtedly correct, the challenges of implementation were greatly underestimated, and their own capabilities were overestimated. There was a lack of necessary online expertise, IT know-how, and the essential experience in transformation to successfully carry out such an implementation. In any case, it was not due to an unstable top management. Between 2017 and 2023, Sparda-BW had the same CEO.

Essential framework conditions are changing, rendering the implementation of the strategy obsolete

Launched with an elaborate advertising campaign in 2012, the Dutch Robobank discontinued its Rabodirect direct banking offering in Germany at the end of 2021. What had happened? The strategy of attracting money from German savers with attractive savings and fixed-term deposit offers failed due to the low-interest rate phase of recent years. Unexpected negative interest rates in Germany and a too narrow product offering (account and savings deposits) resulted in a sustainably loss-making business for Rabodirect, which the Rabobank ultimately abandoned.

Conclusion: Even if a bank's strategy is future-proof, there are numerous reasons why its implementation could fail. Avoiding the mentioned factors does not guarantee successful execution. However, there is hope that the chances of success will significantly increase.

Published in banking, strategy, transformation, failure on 16.01.2024 13:01 Uhr.

E-Mail address

Comment *