'Why Do Strategies of Banks Fail?' - Poll with Surprising Results

Last week, based on some desktop research and reading books such as 'Successful Strategy Execution' by Michel Syrett and 'The Space Between Strategy and Execution' by Gregg Harden, I asked my dear colleagues about

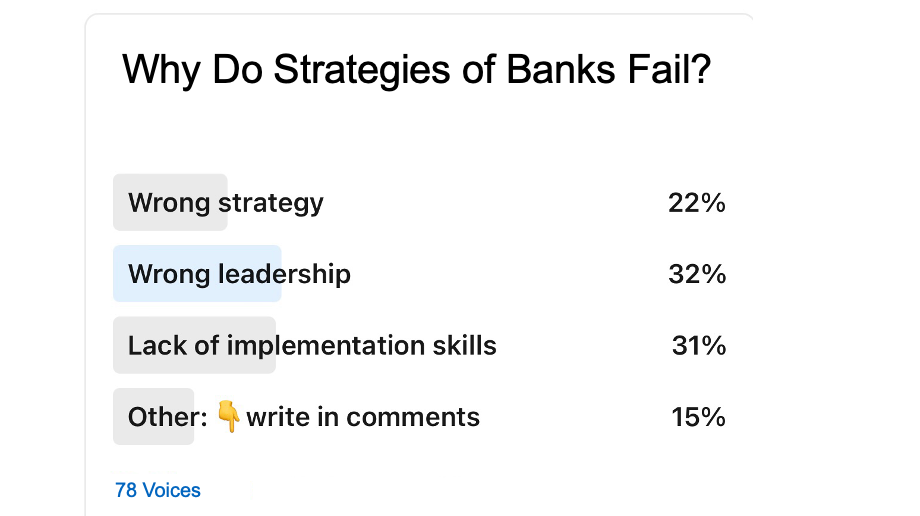

'Why Do Strategies of Banks Fail?‘

Literature suggests that 60 to 70% of all strategies fail due to poor execution.

This aligns with the poll results (78 participants), indicating that only 22% of failures stem from the wrong strategy and 78% for other reasons.

Nevertheless, the various comprehensive and insightful comments from 18 senior people from four continents, including academia, experienced consultants, and current & former CEOs & board members of banks, surprised me.

Here are my 8 key takeaways on ‚why bank strategies fail‘, drawn from all the valuable comments:

1️⃣ Evolutionary Forces in Banking

The banking and finance industry undergoes significant evolutionary forces, marked by non-physical products, high competition, and escalating costs. Ulrich Cartellieri's 1990 assessment of German banking as the "steel branch of the 1990s" resonates today. With up to 50% more bank branches than gasoline stations, questions arise about the need for such proliferation in a digitized era.

2️⃣ Strategy Formulation and Execution Gap

The challenge lies not in lacking awareness or foresight among decision-makers but in bridging the gap between formulating and executing strategies. Alignment in understanding, ownership, accountability, incentives, and corporate culture is crucial for successful implementation.

3️⃣ Missing Ownership and Incentives

Strategies falter when those tasked with execution lack a deep understanding and ownership. Incentives play a pivotal role, aligning personal goals with organizational objectives. Without the right motivations, even well-intentioned strategies can fail.

4️⃣ Lost Core Business Focus

Failure occurs when banks deviate from the core of a functioning business model. For instance, neglecting payments, a core function, can jeopardize consumer and merchant retention. The importance of focusing on the essential aspects of banking cannot be overstated.

5️⃣ Unrealistic Profit Goals

Prioritizing unrealistic profit goals over a sustainable risk portfolio is a recipe for failure. Striking a balance between profitability and risk management is crucial for the long-term health of a bank.

6️⃣ Implementation Challenges

Even well-crafted strategies can falter due to challenges in implementation. Banks may excel in devising strategies but struggle with the practical aspects of bringing them to life, including project management, resource allocation, and change management.

7️⃣ Poor Leadership and Communication

Leadership, from the top to middle management and front-line employees, plays a key role in strategy execution. Communication gaps and a lack of understanding at different levels can lead to poor implementation.

8️⃣ Lack of Consistency

Consistency is crucial for successful strategy implementation. Shifting strategies due to leadership changes or lack of continuity can impede progress. Successful strategies often have clear objectives that remain unchanged throughout their execution.

📌 Conclusion

In conclusion, the failure of banking strategies stems from a combination of factors, including leadership issues, a lack of alignment between strategy formulation and execution, and challenges in adapting to industry evolution. Understanding the core functions of banking, setting realistic goals, and fostering a culture of innovation are vital steps toward sustainable success in an ever-changing financial landscape.

To the (closed) poll here on LinkedIn: https://bit.ly/429OxCD

🙏🏻 Thank you for your comments

Christopher Schmitz Clare Walsh Ewan MacLeod

Gerald Faust Hans Radtke Henri de Jong

Jim Marous Julian Mattes Karl Ivo Sokolov

Kęstutis Gardžiulis Khaled Abbas Matthias Kröner

Michael Harte Rajeev Kakar Rene Gruner

Robert Caplehorn Tim H. Wolf Wössner

Published in banking, strategy, transformation, failures on 19.01.2024 17:00 Uhr. 0 comments • Comment here